Bristol City Council renews webCAPTURE

Bristol City Council has renewed its contract with Govtech for the webCAPTURE digital process automation service for...

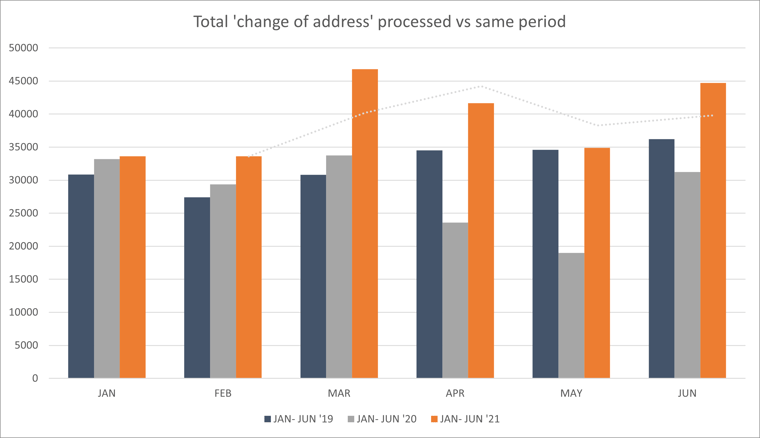

Excuse the pun but, in the midst of the holiday season, the continuing significant rise in the number of Council Tax ‘change of address’ transactions we’re receiving illustrates just how many people have taken advantage of a holiday on stamp duty.

A comparison of webCAPTURE transaction numbers for June 2021 reveals a 43% increase in changes of address automatically processed, compared to the same month last year. Of course, lockdown one halted movers and impacted 2020 numbers, but if we still compare like-for-like to 2019, it is clear to see that our data taken from a sample of 30 local authority customers supports other evidence that tax relief got the housing market moving again.

And this has made customer investments in our digital process automation services even more vital in helping them to manage the increased workload.

Experience, alongside a stable annual cycle, enables local authorities to accurately predict peaks and troughs in Revenues & Benefits transactions and plan resourcing arrangements accordingly. Every council expects bill enquiries, new direct debits, discount applications and change of address reports to peak immediately after annual billing, for example. Student applications for discounts or household exemptions rise every year from June, ahead of the September intake. But, apart from annual billing, volumes of household ‘change of address’ notifications are generally quite constant and predictable. That predictability has been shown to disappear when a stamp duty holiday that can save people up to £15,000 is nearing its expiry.

Everybody seems to know somebody who has moved house recently.

Perhaps we should all have taken more notice of what we were reading and not been that surprised:

“The stamp duty holiday definitely stimulated the housing market…Estate agents reported a surge of interest in March as buyers and sellers rushed to complete property deals before the scheme was initially due to end. The holiday was then extended until the end of June.”

BBC News: Stamp duty holiday: How much do I have to pay now?

In the months preceding the original end of the stamp duty holiday in March, Council Tax ‘change of address’ transactions automatically processed by webCAPTURE were steadily increasing. Year-on-year, that increase peaked at the March ‘21 cut-off date and then peaked again when the holiday narrowed in June ’21. As our chart shows, the tax holiday certainly encouraged movers to make the most of the opportunity and, with a significant growth in volumes compared to the same period in 2020, the automation delivered by webCAPTURE was a blessing for councils still coping with pandemic-related workloads.

webCAPTURE, our hosted digital process automation service for Revenues, has supported our customers throughout the pandemic. More recently, it has absorbed the workload peaks generated by the stamp duty holiday. Automated processing of these transactions in the Revenues system simplifies collection because changes are processed much more quickly and new bills generated within 1 day of receipt, giving customers the maximum possible time over which to spread payment. Councils struggling with pandemic-related priorities have relied upon webCAPTURE as the workhorse for day-to-day business as usual changes, freeing up their time to focus on collection and assisting those who are experiencing payment difficulties.

House move transactions are still above their pre-pandemic 2019 levels. With nearly all pandemic-related support schemes, including the stamp duty holiday and furlough, coming to an end, it is more than likely that a return to normality will be prove to be a bumpy road. Watch this space.

webCAPTURE automates around 80% of the manual processing that currently consumes team resourceRealise the potential of digital process automation:

|

Last January, after Christmas and New Year celebrations were curtailed again, we saw off the peak in Omicron infections without these translating into mass...

Bristol City Council renews webCAPTURE

Bristol City Council has renewed its contract with Govtech for the webCAPTURE digital process automation service for...